Weekly Oil Report: Hopes for a Steady Crude Market

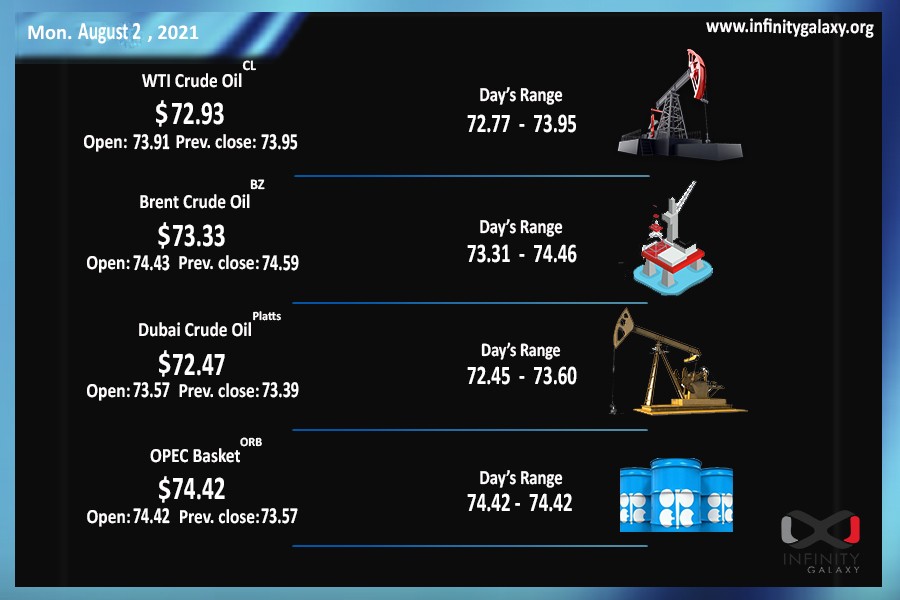

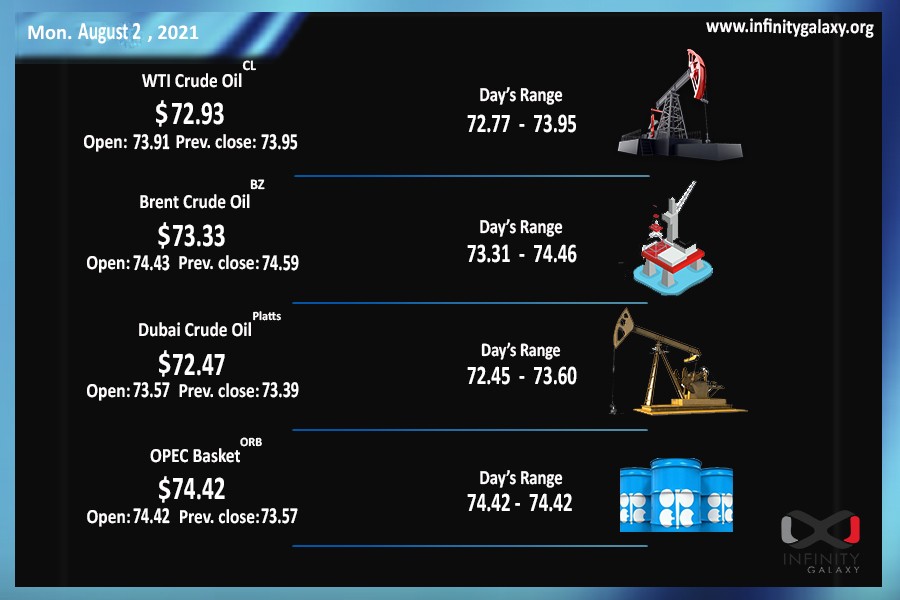

Crude had a stable week at the end of July. Brent closed the week at $74.85, and West Texas Intermediate stopped at $73.66 on Friday, succeeding to keep close to Brent price. According to the technical analysis, the price has already stabilized between $70 to $75. We expect a steady market in the mentioned range.

On the monthly Reuters poll, oil analysts and economists stated that they believe $70 oil is more realistic at the end of 2021. They do not see hitting $80 as an impossibility for crude, but they assume it is not sustainable as demand decreases at those prices. OPEC is also monitoring the market constantly to balance supply and demand. The allies know if the price booms suddenly, it would discourage traders.

“The wax and wane of COVID-19 waves will have more of an influence on sentiment rather than supply and demand fundamentals during the rest of the year, as we do not expect politicians to impose hard and broad-based lockdown measures anymore.” One of the Julius Baer Group’s analysts, Carsten Menke, said in an interview with Reuters.

Despite the increasing rate of the Covid outbreak, the Federal Reserve did not change the interest rate. It seems they will stick to the 0.25 interest rate by the end of 2021. The U.S crude inventories also decrease oil inventories by over 4 million on Wednesday.

The economies are promising as the PMI reports were release above considerations. Therefore, producers are still active in the market. Petrochemical refineries are also in better condition with oil settling down at $70.