Weekly Oil Report: Holidays and Lockdowns Ruling over

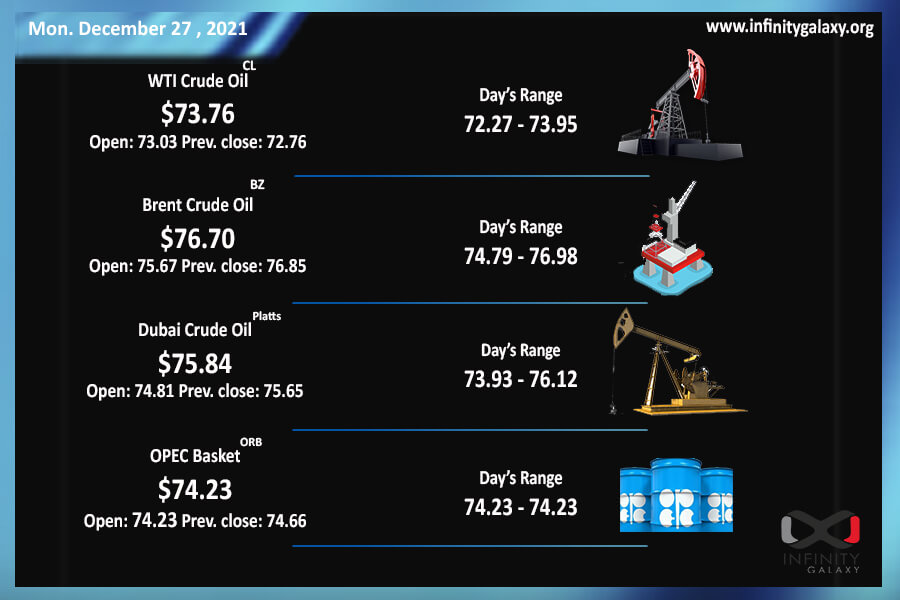

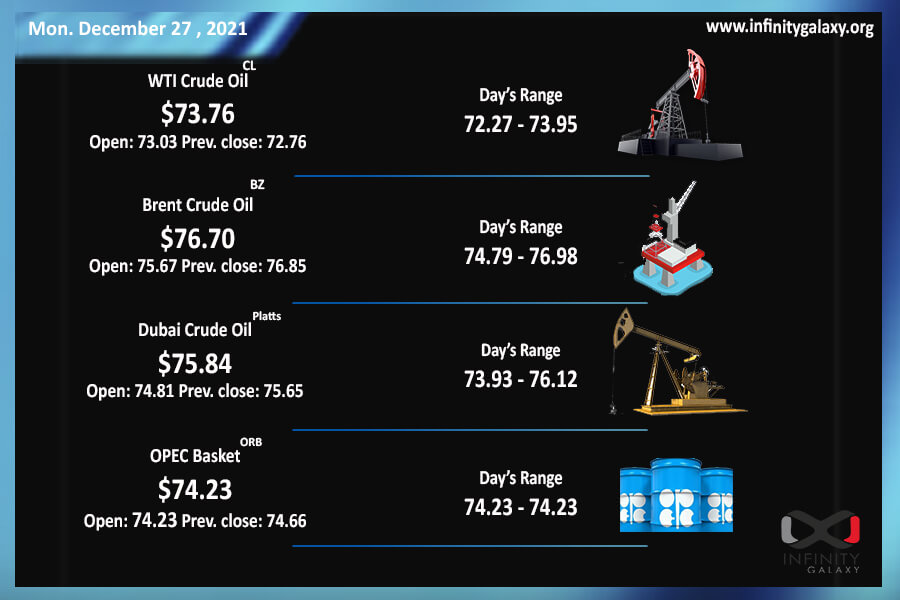

Christmas is here and crude oil finished the year in the same range as last two weeks. Holidays got markets into sleep in many countries. Brent started Monday’s market at $75.75 and WTI began with $73.72 and climbed slightly down. The downtrend is not over yet with the negative sentiment of Omicron and demand fall. The price might touch $70 as well with rising infections.

The US inventory changes brought some fluctuations to the market; however, we shall wait to see OPEC new decision on Tuesday, 4 January regarding supply.

Omicron is spreading rapidly in countries and overtaking the Delta variant. Holidays flights were cancelled in the US and several European countries as reports claimed a sharp rise of infections. Christmas holidays have boosted the pace of infections. Luckily, deaths are lower than the Delta variant but the quick spread of the virus can bring another global lockdown.

There was no new Federal statement as bank holidays are also started. The interest rates forecast is still showing a possible rise in 2022 but the rising infections can change the plans.

Petrochemicals had a stable market along with the usual fluctuations of crude. Although there is some news about price decrease in countries such as India, traders are still eager to seal their deals in the ending days of 2021. Construction projects are still running as they were planned; therefore, constructors and market participants are gathering the required raw materials.

| Visit the latest Bitumen Price |