Weekly Oil Report: Global Fear of Recession Intensifies

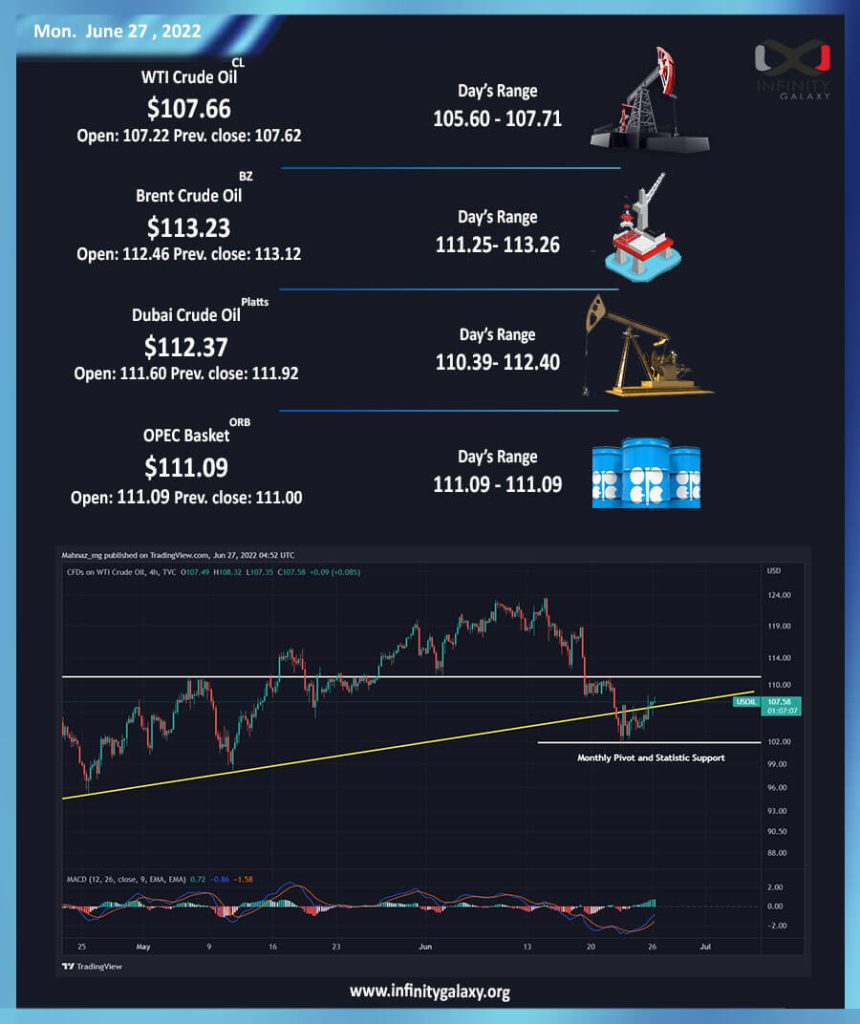

Crude oil fell to $110 under the pressure of weak demand and fears of the global recession. It was the third consecutive week that the oil price dropped. Brent closed at $112.44 and WTI settled down at $107.53 on Friday.

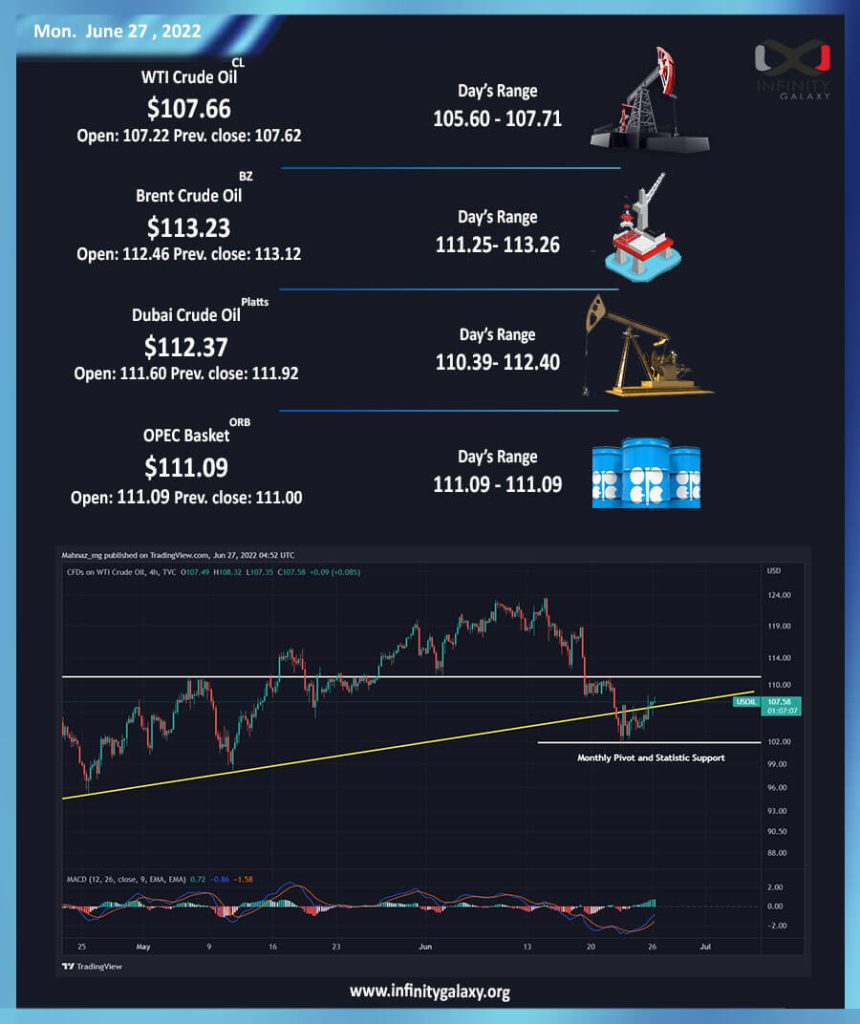

As you can see in the WTI chart, it could record 101.55 as the lowest price of the week. The price, then, returned upward toward the former resistance around $105. The static support- the white line at $101 – is still strong enough to hold the price.

Price came out of its price trend and seemed to break the support at $105. You can see that the price is recording higher lows while MACD shows more selling pressure; therefore, we can say that it might be only a fake breakout. The price might get to $110 during the week and stay volatile among the two white lines in the chart.

The fear of recession is spreading in the market since most analysts believe that the US cannot tame inflation through its current policies. Although the Federal Reserve is increasing the interest rate, it might be too late. The new reports in July will be important for the market.

The dollar is getting stronger since the declaration of the new interest rate. It has increased the pressure on the oil prices as well.

The zero-covid policy is making more trouble for China. The demand and supply outlook stays dim for the country and traders cannot set their targets.

India is speeding up the import of Russian crude. The amount of the oil that the country has imported in 2022 has been five times its 2021 imports. Private refineries are receiving most of the imported Russian oil. India’s top refiner, IOC, also forecasts crude to stay above $100 for 2022.