Weekly Oil Report: Crude Surged Ignoring China Attempts to Stop It

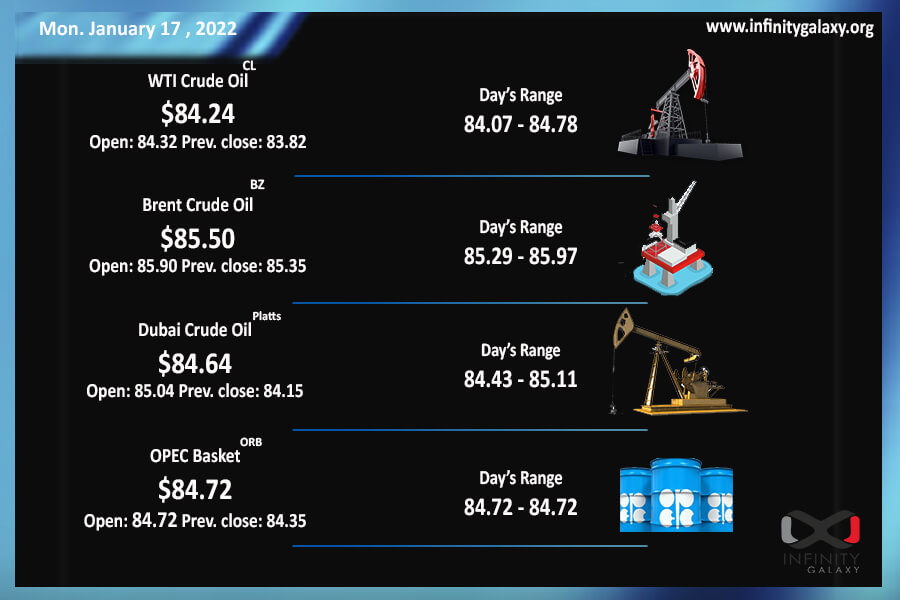

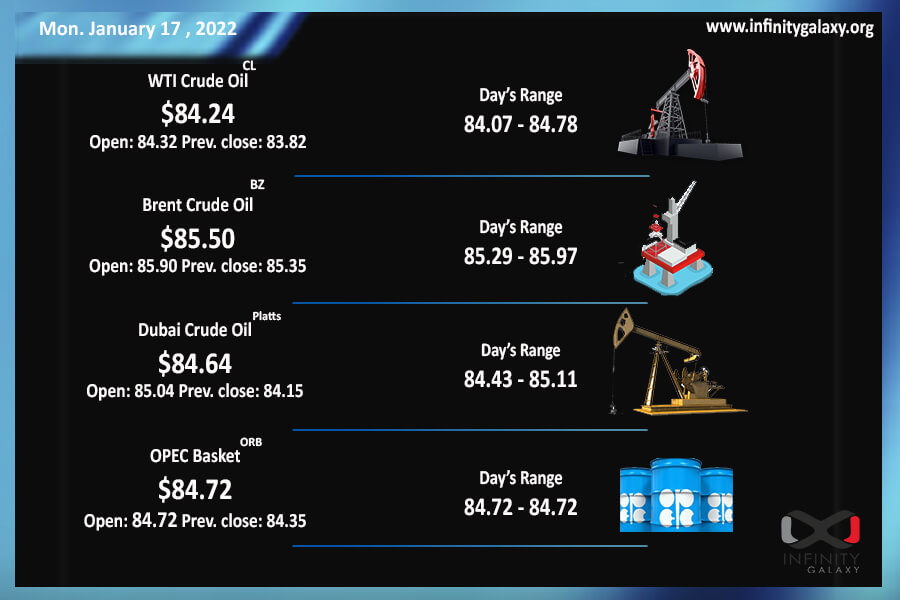

Supply constraints and dollar weakness stimulated crude oil by over 6% during the week. Brent closed at $85.66 and WTI got to $84.39 on the Friday session. Geopolitical risks led to more gains. The price is likely to remain above $80 for the rest of the week.

China tried to kill the crude oil rally by releasing its strategic reserves but it failed. The fever of crude is much stronger than one announcement. As we approach the Lunar new year, we can expect some volatilities in the markets caused by Chinese strategies. The country has not stated the exact amount of the release yet.

Geopolitical issues flared up the uncertainties within the market. Russia-Ukraine disputes, Libyan supply issues, and Iran-US negotiations have puzzled market participants. Disputes will lead to tighter supply; therefore, prices might continue going higher.

The Federal Reserve statements indicated more possibility of raising the interest rate. The inflation reports of the week were also showing a stronger economy. However, the dollar weakened after the report. Sentiments are currently against dollar empowering. The earning reports are also important for traders during this week.

Petrochemicals have been affected by the strong rally of crude. Nearly all petrochemical prices increased in the second week of January. Demand has also grown in various regions. In a similar experience, crude oil rallied high to $84.65 on 26 October 2021. Meanwhile, bitumen recorded the highest price of 2021. The market can expect the same experience with the recent crude movements.