Weekly Oil Report: Crude Slides Under Pressure of Omicron

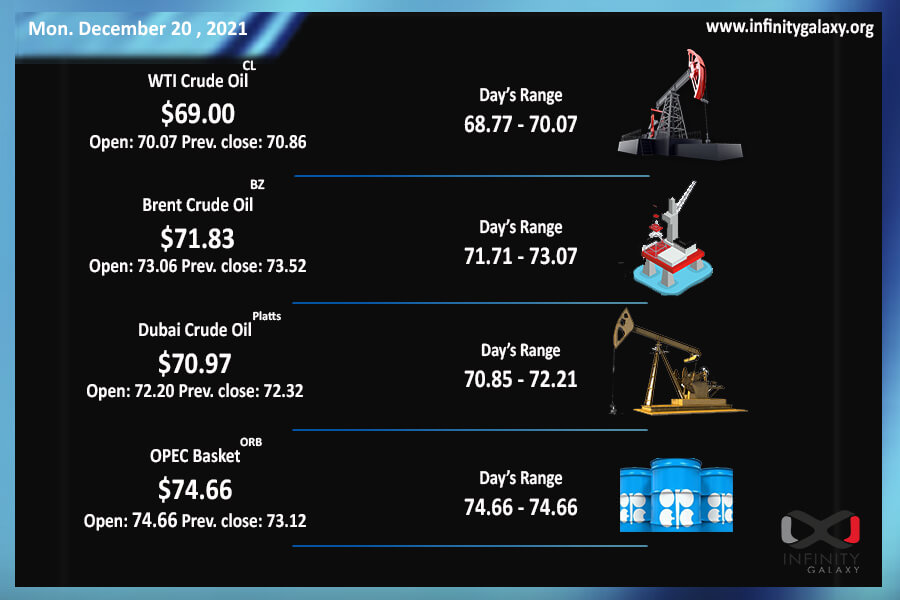

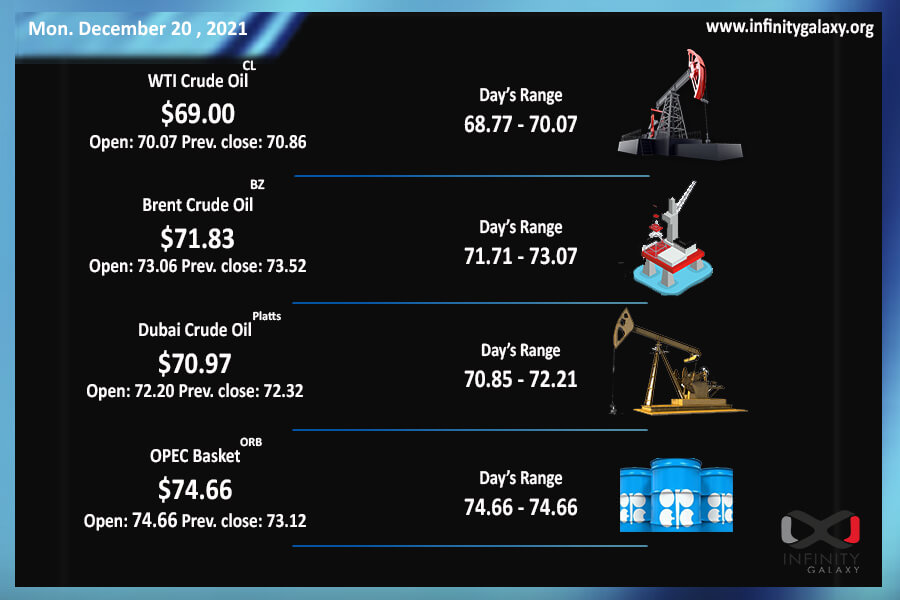

Getting closer to the end of 2021, crude oil is still under $75, as we mentioned in last week report on Monday. The market is full of fears of the new variant of covid once again. On Friday, Brent and WTI closed at $72.78 and $70.35 at the end of the session. They also started the week with another 2% plunge on Monday. As a result, oil fell by about 6% since last week, 13 December. The price tends to go for lower levels as the lockdowns increase.

The resurge of Omicron in Europe and the US has brought back traveling restrictions and lockdowns. Traders and market participants suppose that fuel demand dampens along with restrictions. The new variant is significantly spreading faster than Delta. Christmas travels would boost the spread of the virus. Vaccines seem less efficient against Omicron as the virus is spreading rapidly in countries such as Britain that 70% of people are jabbed.

Considering the current virus condition and possibilities of another hectic outbreak, the economies are taking their next steps conservatively. Unlike former announcements of the Federal Reserve, the committee did not increase the interest rate at the last meeting. However, they stated that the increase is inevitable in 2022. Accordingly, the Dollar index did not fluctuate significantly.

Petrochemicals, on contrary, did not dampen as much as crude. The prices were stable in petrochemicals with a possibility of a decrease; however, the demand is not much decreased. Surprisingly, market participants are still willing to have new cargoes, specifically Indian traders. Spot trading is immensely popular at the moment to avoid any material shortage for the ongoing constructions.

| For the latest Bitumen Price, visit the Bitumen Price Today page. |