Weekly Oil Report: Crude Appeared Determined to Rise

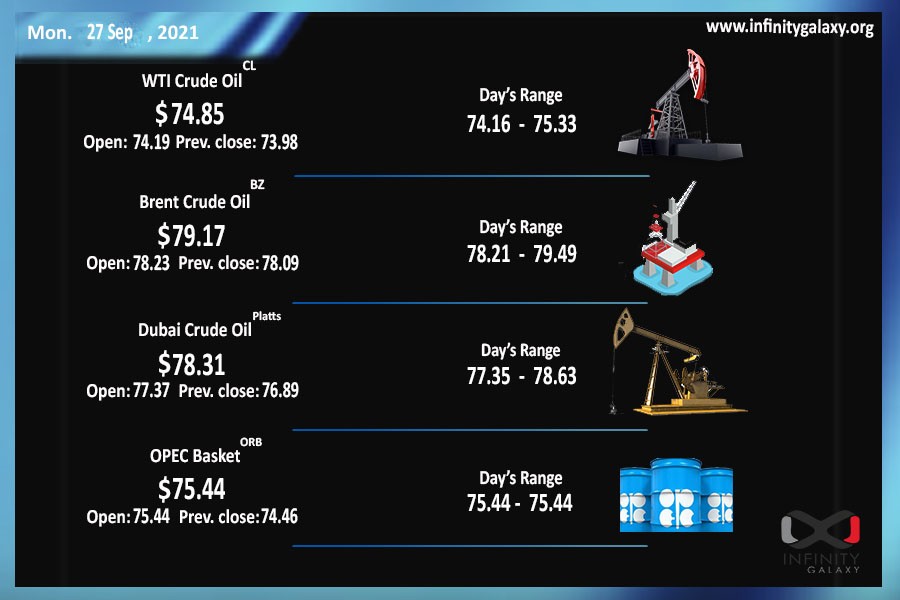

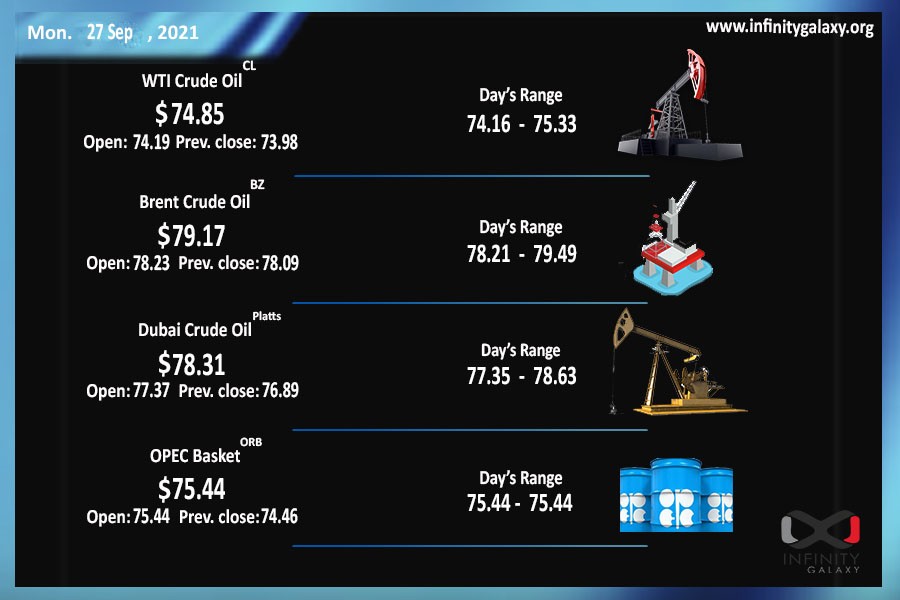

Oil took back the highest price in the last two months then retreated slightly on Friday session. Traders preferred profit-taking seemingly or consider the crude just overvalued at the stated levels. Ultimately, Brent closed at $76.99, and WTI touched $73.96 at the end of the trading session of 24 September.

Crude closed the third week of gains, but the current price seems a bit risky for traders as it fell sharply two months ago from the same price levels. Technically, we might see oil retreating from this point again. However, the demand and market fundamentals have been stronger up to now as the market opened with more gains on Monday 27 September.

Crude supply disruptions stimulated the prices through the week. The Ida hurricane and OPEC countries failing to increase the supply as they had in their schedules were strong incentives. The supply was disrupted in the US as the Ida hurricane made huge damages to the Gulf of Mexico. The US crude oil inventories decreased by 3.5 million over the past week. The Royal Dutch Shell also experienced huge losses after the storm.

The financial institution and hedge fund managers disagree about the fate of oil. Several hedge fund managers believe that oil is having it’s last breathes while financial institutions, including Goldman Sachs, look for prices over $80/100.

Petrochemicals are rallying along with crude. Recent reports from India show that oil products, especially bitumen, will have an over $20 increase soon. Demand is rising as the governments get more efficient in vaccination and restricting the virus.

This article was prepared by Mahnaz Golmohammadian, the Content specialist and market analyst of Infinity Galaxy