Weekly Bitumen Report: Will the Trump–Xi Meeting Bring a Wave of Trade Peace?

The Political and Economic Developments of the Week

Sanctions, Storms, and Asian Diplomacy

Last week, during his trip to Asia, Trump signed memorandums of understanding with the leaders of Thailand, Cambodia, Malaysia, and Vietnam on trade and mineral cooperation. Alongside that, he held an unprecedented meeting with Xi Jinping on the sidelines of the APEC summit in South Korea. Both sides discussed reducing tariffs and forming a basic framework for a trade agreement.

In the Middle East, Netanyahu ordered “strong and immediate” attacks on Gaza, accusing Hamas of violating the ceasefire. At the same time, new U.S. sanctions were imposed on two major Russian oil companies- Rosneft and Lukoil- increasing the risk of energy supply disruptions from Russia. This move could seriously affect Russian energy exports and put upward pressure on the global fuel market.

Meanwhile, Hurricane Melissa, with winds exceeding 250 km/h, swept through Jamaica, causing record-breaking damage. Losses are estimated at over $22 billion, exceeding the country’s GDP. Thousands have been displaced, and large residential areas in the south and west of the island are underwater. Jamaican officials have called Melissa “the deadliest Caribbean storm of the century.”

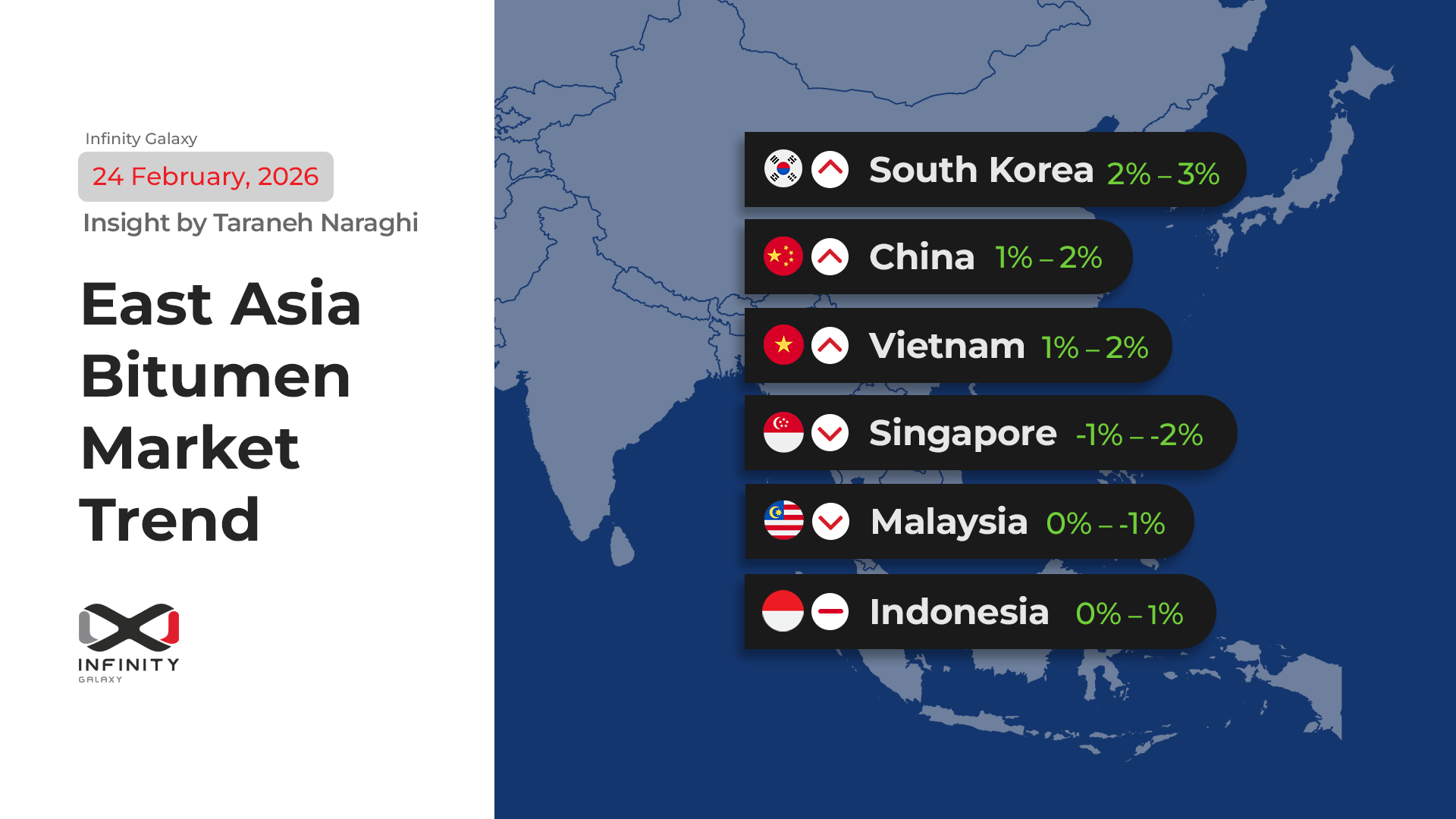

Crude and Fuel Oil Markets in East Asia

Throughout the week, Brent oil prices stayed around $64 per barrel. On one hand, the recent sanctions on Russian companies raised supply risks and prevented a further price drop, and on the other hand, the global inventories remain high. Demand in China and Europe is weaker than expected, a combination that stops any jumps in prices.

On Thursday, Singapore fuel oil was priced at $376, while Singapore bitumen and South Korea bitumen stood at $397 and $370, respectively. Despite the refinery maintenance season, high port inventories are limiting price growth.

Bitumen Market in Bahrain and Europe

Artificial Growth Under Sanctions

Bitumen prices in Bahrain stayed stable at $400 for the second quarter of 2025. In Europe and the Mediterranean, prices rose slightly, about $8 in the Mediterranean and $2–3 in Rotterdam. However, this increase was not due to strong fundamentals but rather a reaction to U.S. sanctions on Lukoil and Rosneft, which caused a short-term rise in oil and HSFO prices. European bitumen prices ranged between $385–410.

| Latest Market Prices (30 October 2025) | |

|---|---|

| Crude Oil | $64 |

| Singapore’s 180 CST | $376 |

| Singapore’s Bitumen | $397 |

| South Korea’s Bitumen | $370 |

| Bahrain’s Bitumen | $400 |

| Europe’s Bitumen | $385 – $410 |

India Bitumen Market

Calm Demand After Diwali

In India, post-Diwali demand has improved slightly after the monsoon season, but the market remains calm. Prices are still under pressure, though refineries are considering small rate increases to cover production costs.

China Market

Construction Halt, Cold Market

In China, the market continues to decline. Prices in the eastern regions stayed the same as last week. Many construction projects are paused, and the government has not yet announced new stimulus plans for the construction sector. Some buyers are holding back, expecting prices to fall further.

Market Analysis of Iran

Waiting for a New Signal in Prices

Iran’s export market remained stable last week, with no major developments. The U.S. dollar stayed steady, and vacuum bottom prices showed no changes either, and it remained almost the same. The market is waiting for a new trigger that could push prices up or down.

The global energy market seems ready for a major shift. Politics, nature, and the economy are involved in this shift simultaneously. On one side, Hurricane Melissa has crippled Caribbean infrastructure, bringing “climate risk” back into energy discussions. On the other hand, U.S. sanctions on Russian giants have made the supply balance fragile. In East Asia, oil seems stable around $64, but beneath that calm lies deep volatility.

Insight by Razieh Gilani from Infinity Galaxy

According to Razieh Gilani from Infinity Galaxy, “The market is pretending to be calm, but any political news could break this silence. Today’s stability isn’t peace, it’s the calm before the next wave.”

Talk to Our Bitumen Experts

At Infinity Galaxy, we’re here to answer any questions about buying bitumen. You can also check the latest bitumen prices by destination. Let us know your inquiry using the form below.

"*" indicates required fields