Weekly Bitumen Report: The Fragile Energy Balance: Which Shock Is the World Moving Toward Next?

The Political and Economic Developments of the Week

Venezuela Tensions and East Asia Friction, Which Crisis Will Push Energy Prices Higher First?

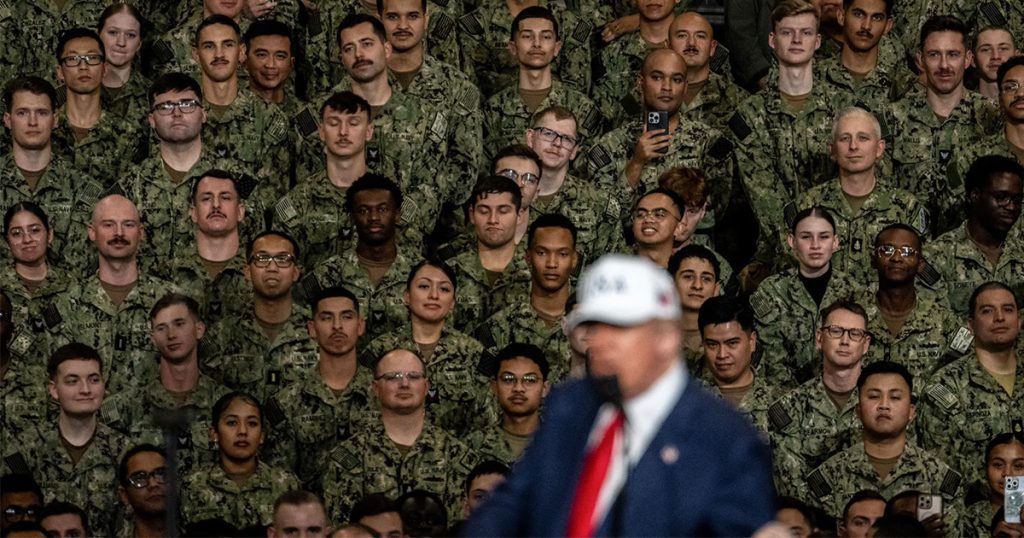

This week, the geopolitical scene came under pressure from several simultaneous events that are reshaping global energy flows and market behavior. The U.S., by sending an aircraft carrier to the Caribbean and increasing pressure on Venezuela, has made the security landscape in Latin America more complicated and raised supply risks from the region. If tensions move beyond political pressure, insurance, shipping, and regional risk costs could rise immediately.

At the same time, the meeting between Mohammed bin Salman and Donald Trump in Washington showed that U.S.–Saudi relations are clearly moving toward closer cooperation- a shift that could directly affect OPEC+ production policy, energy investment levels, and oil-market balance in the coming months.

In East Asia, relations between China and Japan have entered a sensitive stage. Tension over Taiwan, retaliatory sanctions, and strong reactions from both Beijing and Tokyo have made the region more unstable.

Meanwhile, COP30 is nearing its final days without the presence of the U.S., India, and China, the three biggest carbon emitters.

Crude and Fuel Oil Markets in East Asia

Stability or the Calm Before a Jump?

Over the past week, Brent stayed around $64 as the market is caught between geopolitical risks and supply–demand realities. On one side, Venezuela tensions and the East Asia crisis are pushing prices up. On the other side, oil stocks in OECD countries remain above historical averages, keeping the market in a “tight range,” where even small shocks can change direction. Toward the end of the year, the likely scenario is that Brent will move between $62–$68, unless the U.S.–Venezuela conflict escalates and pushes prices into the $70 range.

On Thursday, November 20, Singapore 180CST fuel oil prices reached $352, and Singapore and South Korea bitumen prices reached $391 and $355.

Bitumen prices in East Asian refineries are still trending slightly downward.

Bitumen Market in Bahrain and Europe

Will Europe Break Its Three-Week Downtrend?

Bitumen prices in Bahrain remain steady at $400, showing no reaction to market fluctuations. In Europe, the export bitumen prices fell for the third week in a row. From late October until now, the European bitumen market has been dropping, with last week’s prices reported between $370–$400.

| Latest Market Prices (20 November 2025) | |

|---|---|

| Crude Oil | $64 |

| Singapore’s 180 CST | $352 |

| Singapore’s Bitumen | $391 |

| South Korea’s Bitumen | $355 |

| Bahrain’s Bitumen | $400 |

| Europe’s Bitumen | $370 – $400 |

India Bitumen Market

Will India’s New Project Wave Bring Back High Competition?

Bitumen prices in India are rising- partly because of global oil trends and partly due to limited domestic supply. Seasonal demand from southern and western projects has strengthened, while the north is still affected by pollution restrictions and limitations in the projects. Growing reliance on imports, especially from Iran and the Middle East, has made refinery pricing more sensitive. The market is expecting a rise of $15–$18. The market is generally growing, but buyers are becoming more cautious and prefer suppliers with lower execution risk.

China Market

Winter Project Shutdown, Will the Price Drop Continue?

Following last week’s decline, China’s domestic bitumen prices- especially in the east and south- dropped again. Most road-construction projects in the north and northeast have finished ahead of winter. Buyers are avoiding large inventories before year-end. The continuous price drop in South Korea and Singapore appears to be driven by China’s weak demand.

Market Analysis of Iran

Iran’s Market in Recovery Mode

Iran’s bitumen prices have stabilized on an upward trend, driven by higher VB prices, reduced supply from some refineries, currency fluctuations, and stronger export demand. The upward path is expected to continue gradually.

Insight by Razieh Gilani from Infinity Galaxy

This week’s developments show that the global bitumen market has entered a phase of controlled volatility, where each region is moving on its own path: Europe in correction mode, East Asia with soft demand, and India on a steady upward trend. For professional buyers, this creates an advantage- the chance to plan carefully and purchase at the right moment.

At Infinity Galaxy, as always, we monitor the market daily and work with stable sources to help you choose the best timing, best conditions, and best options for your projects. Markets may change, but our commitment stays firm.

Talk to Our Bitumen Experts

At Infinity Galaxy, we’re here to answer any questions about buying bitumen. You can also check the latest bitumen prices by destination. Let us know your inquiry using the form below.

"*" indicates required fields